AXA Global Healthcare yra pirmaujanti savanoriškojo sveikatos draudimo įmonė Didžiojoje Britanijoje. Daugiau nei 55metų patirtį turinčios įmonės paslaugomis šiandien naudojasi virš 3 milijonų klientų visame pasaulyje. AXA Global Healthcare priklauso antrai pagal dydį Europos draudikei Prancūzų grupei AXA GROUP, kuri yra pasaulio lyderė finansų apsaugos ir turto valdymo srityje. AXA Global Healthcare siūlomas tarptautinis savanoriškas sveikatos draudimas yra naujovė Rytų ir Vidurio Europoje. Lietuvos bei kitų Baltijos šalių draudimo rinkoms šis produktas buvo pristatytas 2006 m. rudenį. Individualūs vartotojai bei įmonės gali rinktis vieną iš trijų draudimo planų bei draudimo apsaugos galiojimo teritoriją. Sveikatos draudimas suteikia galimybę gauti greitesnę ir kokybiškesnę sveikatos priežiūrą, taupo Jūsų laiką ir gali būti vienas iš motyvacijos būdų darbuotojams.

Sveikatos priežiūros bendrovė, kuria galite pasitikėti

AXA Global Healthcare International yra AXA Group, pasaulinės draudimo kompanijos su daugiau nei 107 milijonų klientų visame pasaulyje, dalis. Per pastaruosius 40 metų, mes rūpinomės sveikatos priežiūra milijonui žmonių, kurie buvo išvykę į užsienio šalis, suteikdami gydymo paslaugą – kad ir kur būtumėte pasaulyje.

Siūlome visiems apsidraudusiems puikią naudą, patarimus ir paramą

Žinome, kad šiuo metu yra puikių galimybių ieškoti geresnio darbo galimybių užsienyje, tačiau taip pat suprantame, kad persikėlimas į užsienį gali atnešti ir nerimo- kas bus, jei kas nors negera atsitiktų su sveikata. Štai todėl mes galime užtikrinti, kad mūsų apdraustieji gautų, paramą ir išmokas, kurių jiems reikia, užtikrinant prieigą prie geriausių medicinos įstaigų bei specialistų,

Apdovanojimai

AXA Global Healthcare yra laimėję apdovanojimą, „Geriausias tarptautinės privačios medicinos draudimo paslaugų teikėjas”, „2012 Sveikatos draudimo apdovanojimai”.

Daugiau informacijos

The AXA Group is a worldwide leader in insurance and asset management, with 165,000 employees serving 107 million clients in 64 countries. In 2016, IFRS revenues amounted to Euro 100.2 billion and IFRS underlying earnings to Euro 5.7 billion. AXA had Euro 1,429 billion in assets under management as of December 31, 2016.

The AXA Group is included in the main international SRI indexes, such as Dow Jones Sustainability Index (DJSI) and FTSE4GOOD.

The AXA ordinary share is listed on compartment A of Euronext Paris under the ticker symbol CS (ISN FR 0000120628 – Bloomberg: CS FP – Reuters: AXAF.PA). AXA’s American Depository Share is also quoted on the OTC QX platform under the ticker symbol AXAHY.

AXA Global Healthcare labai platų partnerių sąrašą, kur teikiama stacionaraus, bei ambulatorinio gydymo paslauga.

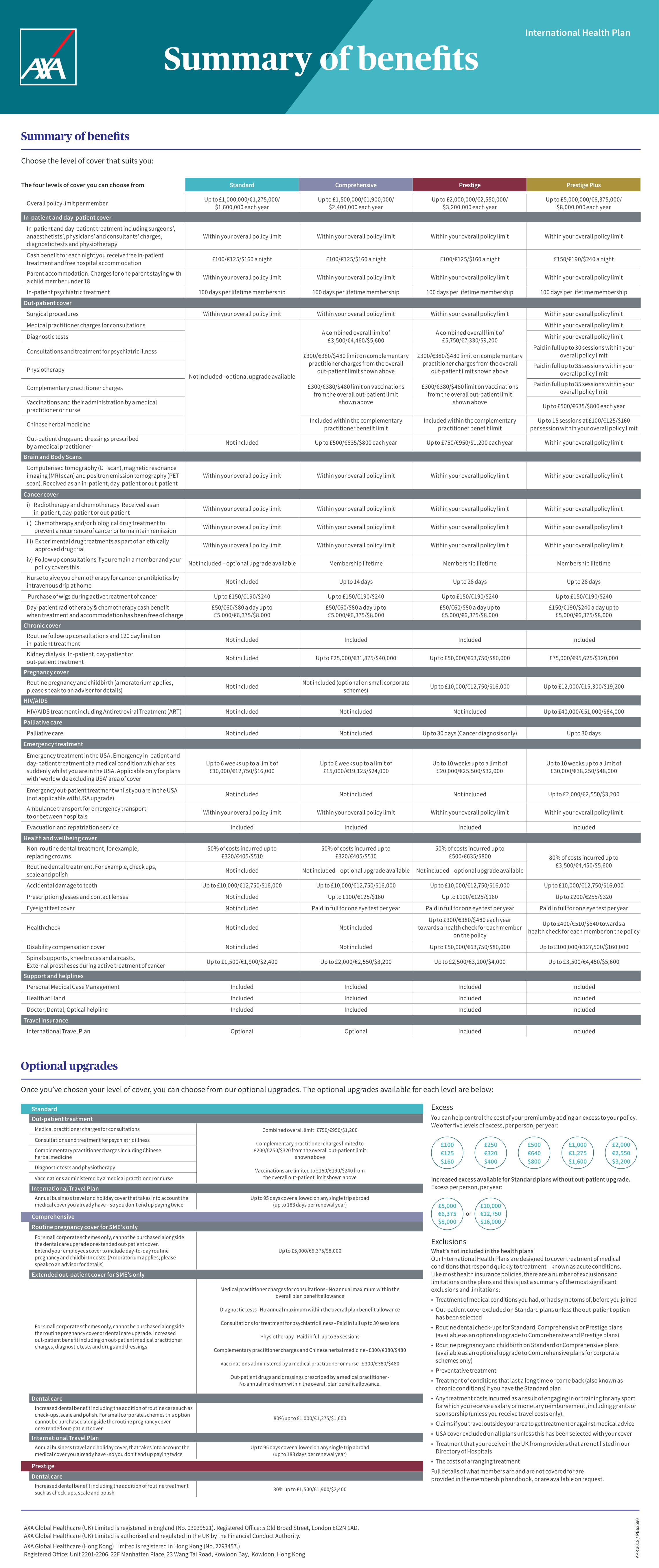

Draudimo planų palyginimas:

https://www.axaglobalhealthcare.com/en/intermediaries/resources/individual/

Gydymo įstaigų sąrašas su kuriais dirbama:

https://select.axaglobalhealthcare.com/s/search-page

Daugiau infomacijos (gydymo įstaigos):

https://select.axaglobalhealthcare.com/s/?expid=AXA_MEM_01&_ga=2.3673203.296001413.1631866805-1346904191.1631866805

Pateiktoje lentelėje galite matyti AXA Global Healthcare teikiamų sveikatos draudimo paslaugų spektrą.

You can help control the cost of your premium by adding an excess to your policy. We offer five levels of excess, per person, per year:

Excess amounts:

- €125

- €320

- €640

- €1,275

- €2,550

Exclusions: What’s not included in the health plans

Our International Health Plans are designed to cover treatment of medical conditions that respond quickly to treatment – known as acute conditions. Like most health insurance policies, there are a number of exclusions and limitations on the plans and this is just a summary of the most significant exclusions and limitations:

- Pre-existing medical conditions; options to include these are available for company schemes of five or more

- Routine dentist check-ups for Standard, Comprehensive or Prestige plans (available as an add-on to Comprehensive and Prestige plans)

- Routine pregnancy and childbirth on Standard or Comprehensive plans (available as an add-on to Comprehensive plans for corporate schemes only)

- Preventative treatment

- Ongoing, recurrent or long-term treatment of long-term illnesses (usually referred to as Chronic conditions) if you have the Standard plan

- Any treatment costs incurred as a result of engaging in or training for any sport for which you receive a salary or monetary reimbursement, including grants or sponsorship (unless you receive travel costs only).

Rizikos vertinimas FMU

With full medical underwriting, the applicant must provide details of their medical history by filling in a medical history questionnaire or answering medical questions during a telephone call. If medical insurance is offered on a full medical underwriting basis, pre-existing conditions are excluded from the policy.

The term full medical underwriting is sometimes shortened to ‘fully underwritten’.

Fully underwritten is one basis for underwriting medical insurance. Other types of basis include ‘Medical History Disregarded’ and ‘Moratorium’.

Gydymo įstaigos su kuriomis turi sutartis AXA Global Healthcare.

Use the map or add filters to find the right medical provider for you. You can choose any provider listed below and we can arrange to pay them directly for your eligible treatment.

Anketa draudimo sutarčiai sudaryti